Funeral Services

- Funeral Coordinator Contact

- Services Include

- Price List

- Grave Cost

- Mortuary Facility

- Planner & Guide

- BAO License

- Tax Implications - Guideline

- Cemetery Guidelines & Updates

Funeral Coordinator

Fareed Ali - (647) 262 - 3433

Our contact service is available 24/7

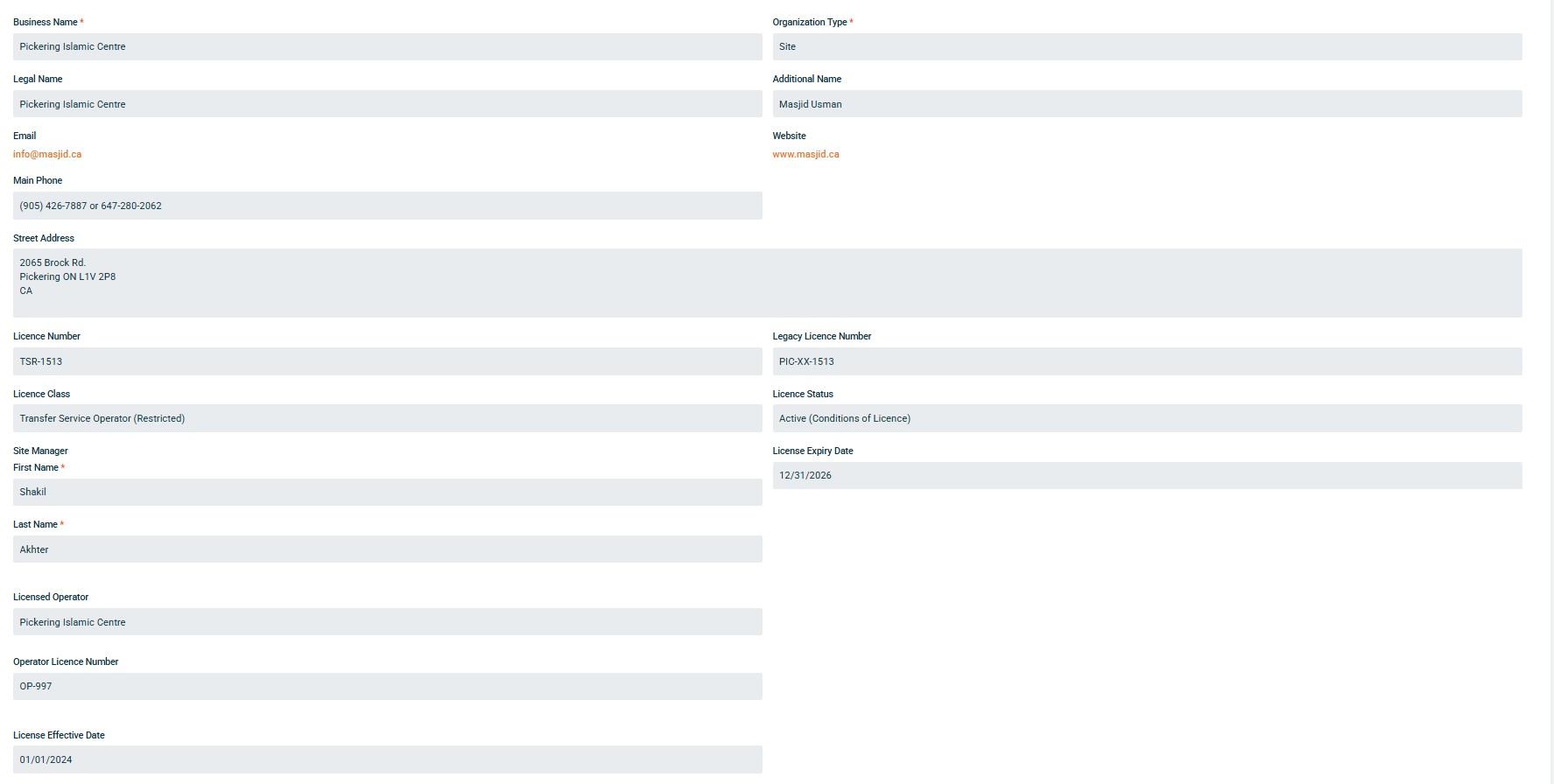

We are registered as Licensed operator, Licence number XX-1513 with Bereavement Authority of Ontario (BAO). For more information please visit their website: www.thebao.ca

Our Services:

Includes the following:

- Transport deceased to our Centre

- Wash body

- Shroud / Kafan

- Coffin box

- Viewing facilitation

- Grave lot arrangements

- Burial arrangements

- Burial Permit

- Janaza prayers

- Transport to the cemetery

- Burial and Prayers

- Related documentation

- Post burial religious assembly at the Centre.

Intake Form for Funeral : Click here to download PDF

Intake Form for Funeral : Click here to download Excel

Price List for Services and Facilities

|

Service |

Description |

Price |

|

Professional and Staff Services Fees |

Co-ordination of services |

$ 250 |

|

Transportation of Deceased |

From place of death (or morgue) to Masjid |

$ 200 |

|

Transportation of Deceased |

From Masjid to Cemetery for Burial |

$ 150 |

|

Use of Vehicle for Transportation of Deceased |

The vehicle and equipment used to transport the deceased person (per trip, one way up to 50 km) |

$ 100 |

|

Additional Mileage |

On occasions where the deceased must be transported additional distanced, a fee of $2.00km will be added. |

$ |

|

Documentation |

Securing and completing necessary permits, forms, certificates, notices of other documents for death registration, burial and/or for use by the family for estate settlement (where accepted). |

$ 100 |

|

Shelter of the deceased |

Use of the holding facility (Ghusl) and/or refrigeration to shelter the deceased |

$ 100 |

Merchandise/Supplies

|

Merchandise |

Description of Supply |

Price |

|

Casket/Container/Coffin |

Basic plywood casket without paint/finish. |

$250 |

|

Shrouding Materials |

5 pieces for female or 3 pieces for male, plus other items |

$100 |

Disbursements

Some charges which are required to be paid to third parties in the provision of services. Some examples of disbursements which could be included in the payment to the Masjid and then paid out on behalf of the family (at cost and taxes where applicable are included) are the following:

|

Disbursement |

Price |

|

Death Registration Fee |

$ 30.00 |

| Death Registration Fee Weekend/Holidays |

$ 53.00 |

| BAO Fee | $ 30.00 |

Summary of the price list is as follows. Payable to Pickering Islamic Center.

| Funeral Service Fee including HST | $ 1,412.50 |

| Death Registration & BAO Fee - weekdays | $ 60.00 |

| Total: | $ 1,472.50 |

Services and Facilities

Terms of Payment : Payment in full is required before departing for burial. Payment may be made in Cash, Debit Card, Cheque or etransfer.

Additional information is available upon request. Prices are subject to change

- Grave opening & closing costs are payable directly to the cemetery. They accept Debit, Credit Card or Cash only

- Grave(land) costs are payable to Pickering Islamic Center. We accept Debit, Cash or Cheque only. Cost of graves are as follows:

| Cemetery | Price before HST | Price after HST |

|---|---|---|

|

Pine Ridge - Adult |

$ 15,000.00 |

$ 16,950.00 |

|

Duffin Meadows - Adult |

$ 3,600.00 |

$ 4,068.00 |

|

Duffin Meadows - Child |

$ 1,300.00 |

$ 1,469.00 |

|

Thornton, Oshawa |

$ 3,390.00 |

$ 3,830.70 |

| Infant | Check with office | - |

Prices are subject to change

Grave Lots are available for purchase at need in the following cemetery:

Duffin Meadows Cemetery

2605 Brock Road N

Pickering, ON L1V 2P8

Phone: (905) 427-3385

Thornton Cemetery

1200 Thornton Rd N,

Oshawa, ON L1J 0C9

(905) 579-6787

Masjid Usman has a well-equipped mortuary to perform washing (ghusl) and prepare the body for burial.

The Coordinator or a PIC representative will accompany the next of kin/family member to the hospital and fulfill all the documents for the release of the body.

Thereafter, the deceased body (mayyit) will be brought in to the Centre for ghusl, preparation, and salatul janazah. It will then be transported to the cemetery for burial. If the next of kin or close family members wish their loved one to be buried in another cemetery, the Centre can make the required arrangements.

Pickering Islamic Centre will issue a “Proof of Death Certificate” (Temporary) to the family of deceased person. This certificate may be required for the settlement of legal issues such as bank accounts, insurance claims, inheritance, etc. The next of Kin is required to apply for a legal “Death Certificate” via Service Ontario.

Pickering Islamic Centre has developed a Funeral Support Planner and a Funeral Support Guide to help community enhance their knowledge on funeral related matters. We have covered religious and government information on the topic.

Funeral Guide: Click here to download

Funeral Support Planner : Click here to download

CPP death benefits guide: Click here to download

CPP death benefit application: Click here to download

Mosque's Type of Licence:

Transfer Service Operator - Class 2 (Restricted)

The following are just general guidelines, and the tax implications can vary based on individual circumstances. Consult with a tax professional or an estate lawyer for specific advice tailored to your situation.

When someone passes away in Ontario, Canada, the tax implications can depend on several factors, such as the value of their estate, whether or not they had a will, and who inherits their assets. Here are some important things to keep in mind:

Capital Gains Tax: If the deceased person owned assets like real estate, stocks or other investments that have appreciated in value, they may be subject to capital gains tax. However, there is a deemed disposition upon death. This means that these assets are generally considered to have been sold at their fair market value immediately before death, which could trigger capital gains tax. There are provisions that allow these assets to be transferred to a spouse or a qualifying trust on a tax-deferred basis.

Probate Fees: If a person dies, their estate may be subject to Estate Administration Tax, also known as probate fees. This tax is based on the total value of their estate. Some assets may be exempt from this tax, such as assets going straight to a surviving spouse.

Income Tax: The deceased person's final income tax return must be filed for the period from the beginning of the tax year to the date of death. Any income earned during this period, including capital gains, will be taxed accordingly. Additionally, any unused tax credits and deductions can be applied to reduce the tax liability.

Tax Credits and Deductions: There are certain tax credits and deductions available to deceased that can help minimize the overall tax burden. These may include the basic personal amount, medical expenses, charitable donations, and others.

RRSPs and RRIFs: Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Funds (RRIFs) can have specific tax implications upon death. The full value of these accounts is included in the deceased person's income for the year of death, unless they are transferred directly to a surviving spouse or financially dependent child or grandchild.

Tax on RRSP or RRIF if No Spouse: If the RRSP or RRIF passes to someone other than a spouse, it may be considered as income to the deceased and taxed accordingly unless the beneficiary is a financially dependent child or grandchild.

Principal Residence Exemption: If the deceased person owned a principal residence, it may be eligible for the principal residence exemption, which can help reduce or eliminate capital gains tax on the property.

Mount Pleasant Group (MPG)

(Duffin Meadows & Thornton Cemetery)

May 17, 2025

Subject: Partnering to Keep Our Cemeteries Safe and Beautiful

Dear Community Partner,

As a valued community partner, we at Mount Pleasant Group (MPG) want to share an update on our cemetery by-laws and ongoing efforts to ensure our cemeteries remain safe, accessible and welcoming for all. We appreciate the role organizations like yours play in fostering community connection and honouring loved ones, and we hope to collaborate with you to share this information with your members.

Our by-laws are designed to maintain the safety, accessibility and beauty of our cemeteries while respecting the diverse ways families and communities commemorate those they’ve lost. Recently, we’ve noticed an increase in non-permitted items placed on or near graves, which can pose safety risks for visitors, staff and groundskeepers.

In January, we began communicating with MPG clients and community members to remind them of our by-laws and request the removal of non-compliant items by July 1, 2025. After this date, any remaining items will be carefully removed and stored for 60 days (until September 1, 2025), giving families the opportunity to retrieve them before they are respectfully disposed of.

Non-permitted items include:

• Fences, railings, patio stones or decorative borders around graves

• Glass, ceramic or other breakable objects

• Unapproved benches, chairs, umbrellas or trellises

• Temporary memorials or signage not pre-approved by the cemetery

Full details on non-permitted items and our by-laws can be found here. This list is not exhaustive.

We understand that these guidelines may be sensitive for some families, particularly those in your community who hold deep traditions of remembrance. Our team is committed to addressing concerns with compassion and is available to work with families to find meaningful ways to honour loved ones within our guidelines. We would greatly value your input on how we can support your members during this process.

If you or your members have questions or receive inquiries, please direct them to their local cemetery office or contact us at [email protected].

We’d also love to strengthen our partnership by inviting you and your group for a special tour of Thornton Cemetery to see firsthand how we care for these sacred spaces. Additionally, we’d be honoured to explore opportunities to collaborate on community events or programs that align with your mission.

At MPG, we believe cemeteries are vital to building strong, connected communities. Thank you for your partnership in helping us maintain these spaces as safe, respectful and beautiful places for remembrance. Please don’t hesitate to reach out with questions, ideas or to schedule a visit.

Best regards,

Hamees Hassan on behalf of Thornton Management Team